4 September 2024

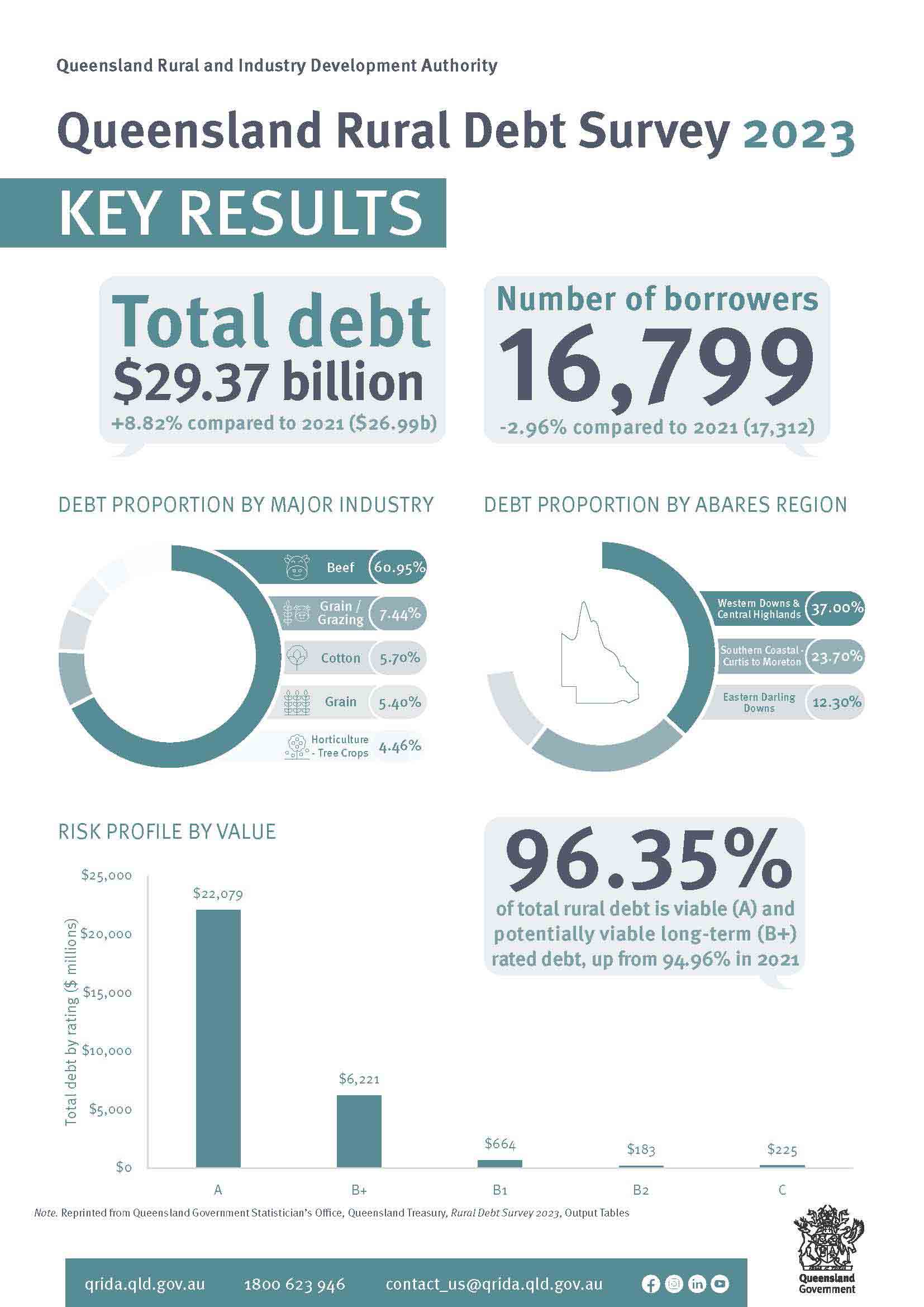

Queensland’s total rural debt has risen to $29.37 billion, up 8.82 per cent from $26.99 billion in 2021, according to the 2023 Queensland Rural Debt Survey.

At the same time, the quality of that debt has improved, with 96.35 per cent rated viable and potentially viable long-term, up from 94.96 per cent in 2021.

QRIDA Economist John Gillespie said agriculture like most business sectors rely on debt to invest, expand and diversify their operations and this biennial survey provided a comprehensive snapshot of the size and nature of rural debt in Queensland as at 31 December 2023.

“Despite parts of Queensland experiencing floods, bushfires and cyclones and economic challenges caused by inflation, interest rate rises and changes to export markets, these latest results show the resilience of our agricultural producers," John said.

"While the number and total value of rural property sales has decreased between 2021 and 2023, the average value of rural property sales has continued to increase since 2021 and is the major rural asset that underpins most rural debt."

The average debt per borrower is $1.75 million in 2023 up 12.14 per cent on 2021 and the number of rural borrowers has decreased by 2.96 per cent to 16,799.

At the same time, there was a 20 per cent increase in State Rural Gross Value of Product (GVP) due to improved seasonal conditions, increased demand for domestic agriculture, and international trade resumption.

QRIDA Acting Chief Executive Officer, Brooke Irwin, said amongst the nine industries that recorded an increase in rural debt, the beef sector ranked the highest with a rise in debt of $2.54 billion due to improved farm gate prices and the significant rise in rural land values.

“Queensland is the beef state and represented the largest portion of Queensland’s rural debt, and it is important to note the quality of that beef debt also improved along with cattle and calf GVP and a substantial growth in Australia’s cattle herd," Brooke said.

Meanwhile, the cotton and sugar industries recorded the largest decreases in debt with reductions of $219 million and $178 million respectively due to improved crop yields and prices.

The three regions with the highest levels of rural debt were the Western Downs and Central Highlands, Southern Coastal Curtis to Moreton, and Eastern Darling Downs with a combined 72.90 per cent of the total rural debt.

These regions represented the same proportion of total rural debt as in the previous 2021 survey due to the large primary production activity and diverse range of industries in these regions.

The survey was undertaken by the Queensland Rural and Industry Development Authority (QRIDA) in collaboration with the Queensland Government’s Statistician’s Office (QGSO) and with the support of all major lenders and insights from agricultural industry organisations.

For more information, see the full 2023 Queensland Rural Debt Survey and interactive dashboard.

Editor’s Note: The Rural and Regional Adjustment Act 1994 (Qld), formally requires QRIDA to undertake the Queensland Rural Debt Survey every two years unless an equivalent national rural debt survey is available.

Rural debt is defined as the total indebtedness of all farmers and rural enterprises throughout Queensland, where the servicing of the rural debt relies primarily on rural generated income.

The next Queensland Rural Debt Survey is scheduled for December 2025.